MY NUMBER 1 RECOMMENDATION TO CREATE FULL TIME INCOME ONLINE: CLICK HERE

I think it’s already safe to say that the buzzword in 2022, both in the markets and in the economy, will be “inflation”.

Last week’s higher-than-expected cost of living index kept the Federal Reserve in aggressive inflation-fighting mode, and after Wednesday’s latest rate hike, investors are now worried (again) that the Fed’s fight could send the economy into recession.

As a result, it’s been a tough week for stocks, so I’m not trying to rub salt in the wound, but the fact is that inflation is worse than what we’re hearing. The government tells us inflation is just under 8.5%, but that is ridiculous.

This burger meal even proves it…

Everything on that plate is much higher than the “official” inflation rate.

You’ve experienced it too… at the gas station, the grocery store, and many other places.

The question for investors is: How the hell are we supposed to beat the skyrocketing cost of living if we can’t even fix the information on how fast real prices up?

There is an answer…

A distorted truth

Many Americans did exactly which we should. They worked hard. They were saving. They bought index funds. They paid off their mortgages.

Even with official inflation of 8.5%, someone retiring tomorrow with half a million in their account would lose it all in six years, according to my calculations.

But this “big money illusion”—that inflation is less than it really is—has fooled them. This makes them think they are much safer than they really are.

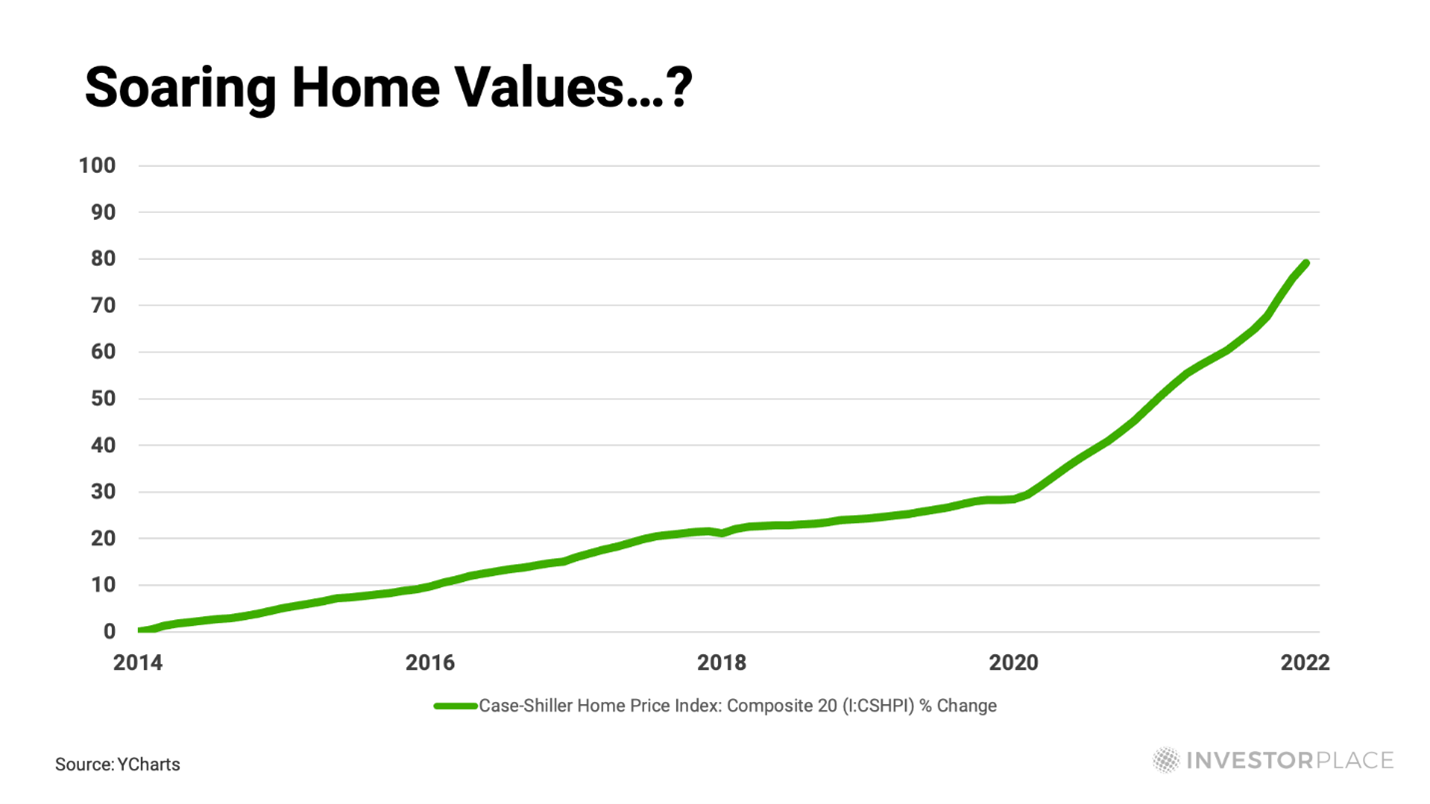

A good way to illustrate this is with home values, which have increased dramatically in recent years. Or are they?

This is a chart of the rising Case-Shiller Home Price Index. Homes certainly seem to have added hundreds of thousands of dollars to people’s net worth in recent years.

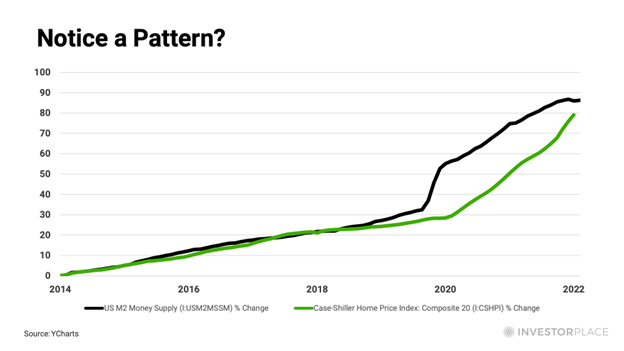

Before you draw a definitive conclusion, let’s look at the chart again with the addition of the so-called M2 money supply, which is basically cash, checking accounts, and the like.

It’s almost an exact match. So it’s not so much the value of the things that go up, it’s that the dollars you buy them with have gone down. Remember, the government printed trillions dollars in cash in recent years. This is where this inflation comes from.

This same situation repeats itself over and over again, every time you try to measure market performance against the background of this “big money illusion”. Because inflation – be it the “official” rate of 8% (or even just 3%) or unofficial real rate of increase in prices – will always reduce your returns.

And because the “Big Money Illusion” distorts the truth about how much you’re actually at risk of falling behind, it’s not enough to just beat the rising costs. You have to beat them with a LOT. This is the only way to ensure a sufficient margin to be safe.

Fortunately, there is a way around this.

Onward through good times and bad

I’m not talking about some of the traditional inflationary investments you’re probably familiar with, like gold, real estate, or inflation-protected bonds.

After four decades of studying the markets, I am absolutely convinced that the single best way to escape rising costs is the same as the best way to create real wealth. Same as the best way to consistently beat the markets.

It’s as simple as owning it the highest quality individual stocks you can find.

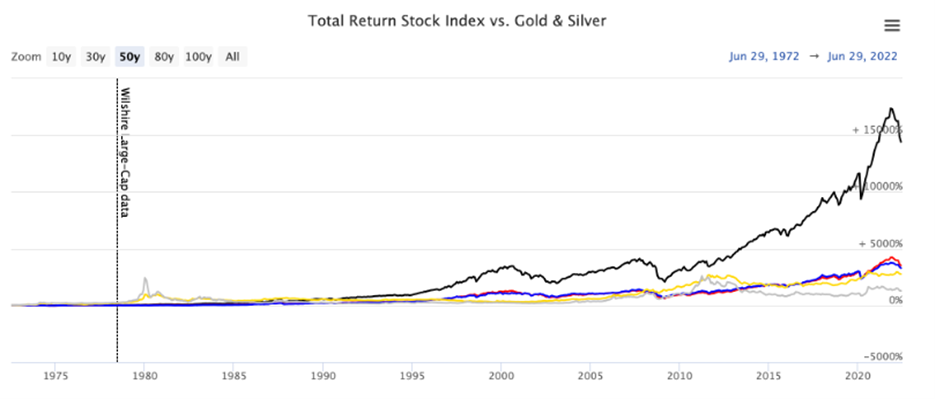

Let me show you what I mean in one more chart…

What you’re looking at is a comparison of the performance of gold, silver, the Dow and the S&P … and a mix of high-quality, cash-rich stocks.

Note that we are talking about 45 years of data. This includes oil and pipeline wars, recessions, crashes, currency crashes, and even terrorist attacks and political scandals.

The cash rich companies completely crushed other investments.

Many investors are unaware of this hidden risk of real inflation, but it’s important to be aware of, especially now that the impact on your portfolio is greater than usual. I present it to you in a new video presentation here.

And if you want to learn more about finding money-rich investments that crash the market, that’s exactly what my system does. Stocks on mine A growth investor Shopping lists sales and profits are growing, hitting top fundamentals and seeing strong buying pressure. For instant access to my top picks and more, click here to become a member of Growth Investor.

With respect,

Source: InvestorPlace unless otherwise noted

Louis Navellier

PS There is “Impact Event‘, which I believe could offer investors some of the greatest investment opportunities of their lives.

Bank of America says a $150 trillion aftershock is about to hit … and could send tremors through markets for decades.

Click here now if you want to know what this important event is, how to prepare… and even get the name of the best stock, I recommend you buy it.

MY NUMBER 1 RECOMMENDATION TO CREATE FULL TIME INCOME ONLINE: CLICK HERE